Get an ESG Certificate

with the easy-to-use Global Sustain Rating Application

Easy-to-use

Certified method

Transparent results

FREE Registration

Robust and Innovative Application

The Global Sustain Rating is a comprehensive application for the collection, analysis, and evaluation of Environmental, Social and Governance (ESG) data.

How it works

Credibility and Validity for the evaluation of business, credit, and investment decisions

FREE Registration

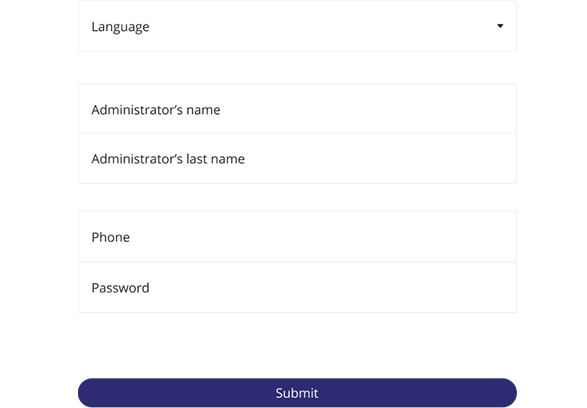

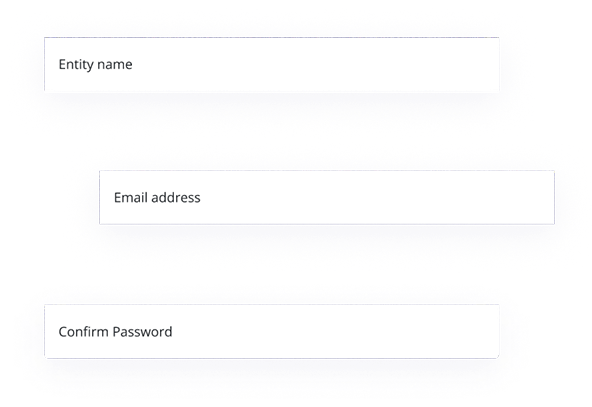

User registers and creates an account for free. Users can be companies, organisations, entities in general that wish to collect, measure and manage ESG data and performance.

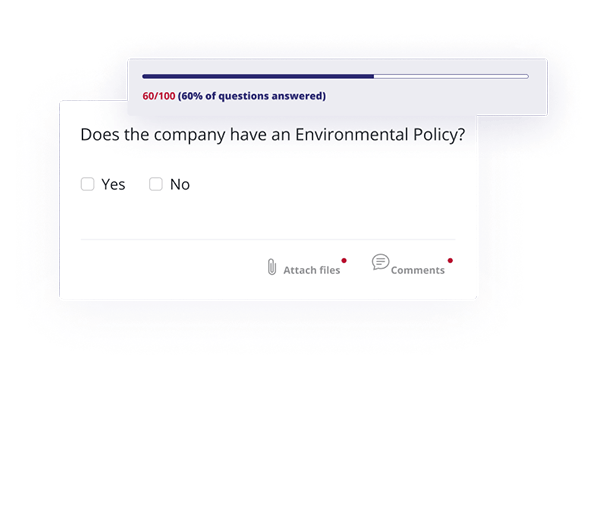

Questionnaire

The company (user) completes a questionnaire with questions about the measures it has taken to demonstrate performance with ESG criteria.

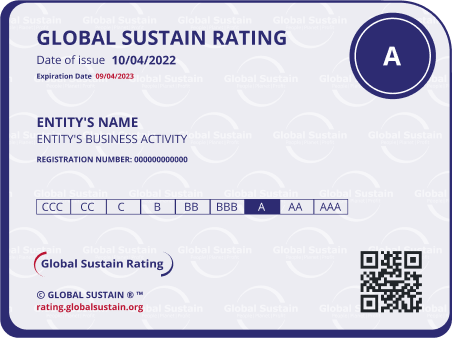

Certificate

After completing the questionnaire, the company receives certificate for own use.

Global Sustain Rating Methodology

Credible and comparable data.

- Commercial and investment bank

- Green bond issuers

- Development organisations and international financial institutions such as IFC, EBRD, and IDB

- Asset managers, private equity funds and sovereign funds

- Rating agencies and business intelligence companies such as Moody's, S&P, Bloomberg, Thomson Reuters and ICAP

- Development of ESG assessment applications for banks and investors

- Development of sustainable lending products (ESG/Sustainability-Linked Loans)

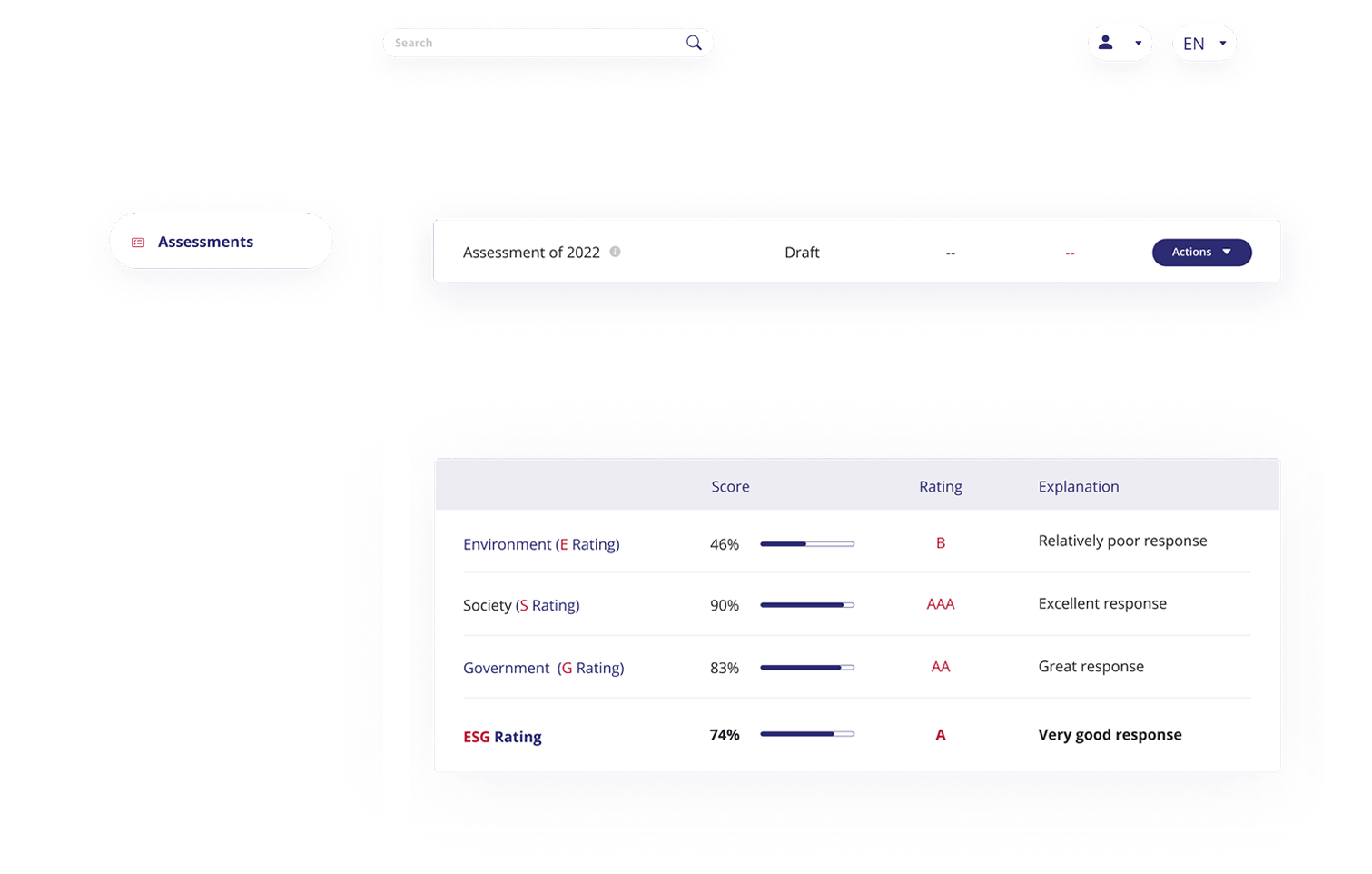

- Rating Report with explanation

- Access to comprehensive information and history

- The data on which the rating calculation is based

- Comparability of ratings between similar entities (benchmarking)

- Identifying and quantifying entities' incorporation of ESG factors

- Improving the image of the entities in the market

- Access to finance, credit and investment

Read more

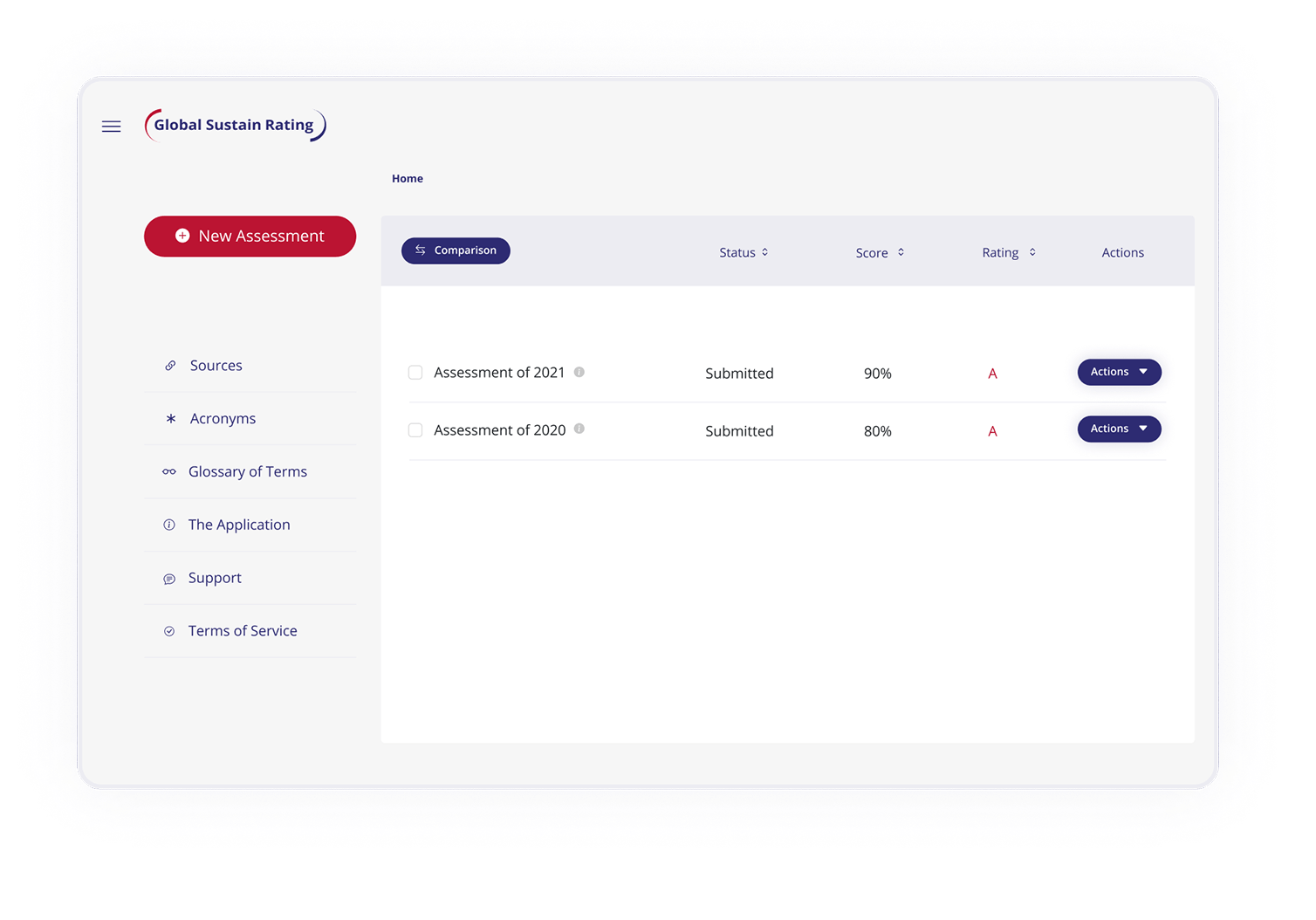

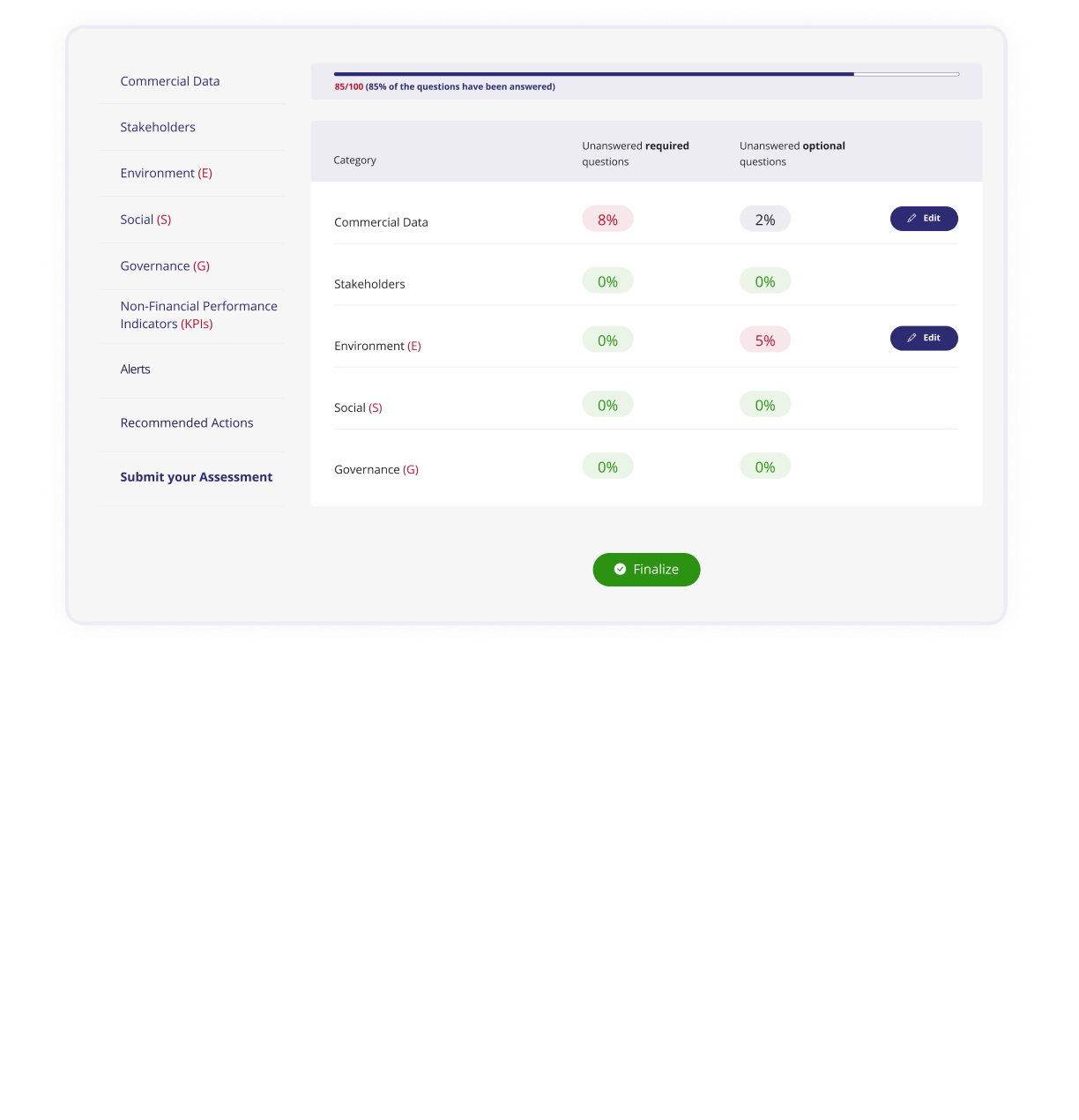

The Application consists of the following sections:

- Commercial Data

- Stakeholders

- Environment

- Social

- Governance

- Unanswered Questions

- Non-Financial KPIs

- Global Sustain Rating

- Alert Messages

- Reporting

- ESG Action Plan

- References

- Glossary of Terms

- Acronyms and Abbreviations

- Terms of Use and Disclaimer

- Help Desk

The Application has been developed to be used by all types of entities such as companies and organisations regardless of size and industry, banks, and fund providers (investment companies and fund management companies) for the evaluation of business, credit, and investment decisions.

The questions selected by Global Sustain are in line with the following standards, guidelines, regulations and circulars:

- EU Sustainable Finance Disclosure (SFDR) Regulation

- EU SFDR Regulatory Technical Standards (RTS) Regulation

- EU Taxonomy Regulation

- EU Non-Financial Reporting (NFR) Directive

- EU Commission Guidelines on NFR methodology for reporting non-financial information

- EU Corporate Sustainability Reporting (CSRD) Directive

- EU Corporate Sustainability Due Diligence (CSDD) Directive

- Stock Exchange ESG Guidelines

- National laws and regulations on Corporate Governance Code.

The Application is updated at least once every year (rating cycle), in terms of content and the completeness of the questions. The update is based on relevant regulatory frameworks, directives and regulations, so as to take into account new requirements of supervisory and regulatory authorities, as well as non-financial disclosure standards. Also, an update is made to the methodology for calculating scores and ratings, to take into account the change in the entities' performance from year to year, with the support of a dedicated Rating Committee.

Contact us and request a demo

Do not hesitate to send us a message to schedule a free demo.